Stay ahead of the game with our comprehensive private company insights

Our integrated solutions can help you quickly visualise value chains, understand company fundamentals, and dive deep into private company growth potential, competitive landscapes, and more. Request a demo.

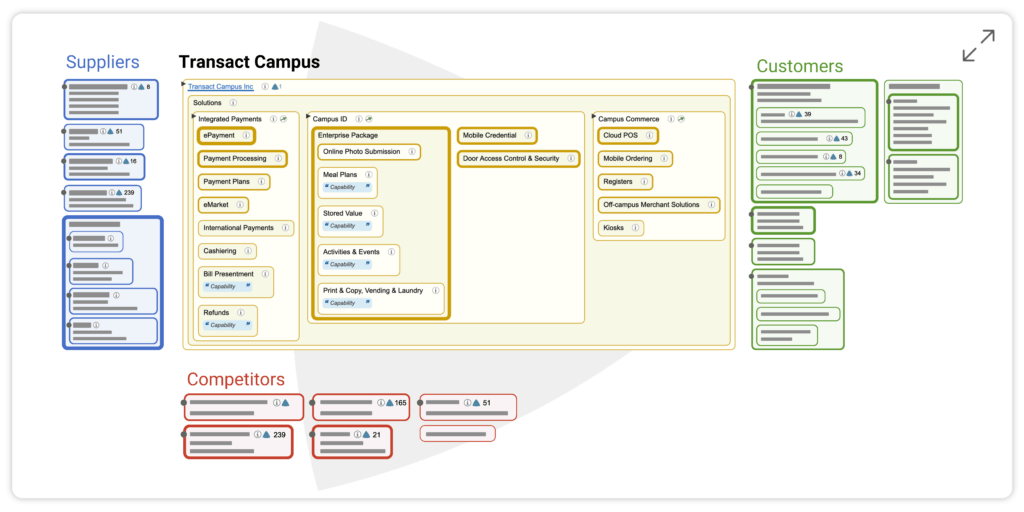

Get an exclusive glimpse into Transact Campus’s value chain map and insightful company information.

The value chain image is generated from Third Bridge Maps.

The following transcript is generated from Third Bridge Primers, providing fundamental information on privately held companies from unique human insights, enabling investors to quickly understand a company in early-stage research.

Each Primer interview is moderated by a Third Bridge analyst and covers standardised questions with a former company executive who has had P&L responsibilities.

Please scroll down to the bottom to view selected answers. Submit your details to gain access to our premium content.

Specialist

Former C-level Executive at Transact Campus, with over 18 years experience in the edtech industry

Questions covered

- Company Overview

- Market Growth & Drivers

- Competitive Landscape

- Company Performance & Growth Potential

Questions

Transcript

SP: First, you would look at the vertical of education. In the United States, we call it K through 20, Europe call schools, and then universities, but it is that, and all those cases, if you think about the fundamental notion that an institution has to ensure that who [the student] he is and he is able to receive, or not receive, certain services, whether those be financial services, whether those be teaching and learning services, whether those be facility access services. You think of the core market being verticalised K-20.

Then, I think about adjacencies, especially adjacencies in hospitals, or what we call academic medical centres. Many of the universities have academic medical centres and so you have students flowing through that as well, so it’s a nice bridge, it’s a very tight adjacency, and they have many of the areas, from physical access facilities to dining facilities for the hospital, as well as parking and in and out of parking, all those aspects are relevant to a hospital environment.

Also, from a payments side, I believe there’s an opportunity to move into payment, so bill payment and presentment side of that house, so I think that’s a nice adjacency. I would say, in general, any company, like Boeing, Transact had major clients that have a corporate campus environment, it works very nicely in a corporate campus environment.

SP: One would logically say, because of the tailwinds, it’s higher in the payments world than the campus engagement world. I think you have to be in the double digits in growth or these companies should be in the double digits in growth. When you think about market, I think the potential, the TAM [total addressable market], vs a SAM [serviceable available market] right now, I think the growth is stepping out of the United States, from number of institutions. You think about the number of higher education institutions in the country, what is that serviceable addressable market, and how do you grow that. From a market perspective, I think that opportunity is outside the United States, the major growth opportunities, because, in my experience in travel, there are a lot of little, small providers, point providers that you would have to put together five little point providers to even get close to what any of these companies in the United States can do. I think that’s an opportunity there.

TB: Would you say over the past three years, market growth has been in double-digits, so 11-20%?

SP: I think it should be just low teens in its growth, aggregated. I want to delineate the serviceable addressable market vs the growth in revenue, which is much, much higher because of the upsell capability of bringing new products online. That has always been very strong and powerful in the organisation because once you have an operating system at an institution, you can add new products and services to that, the upsell is never easy but there’s less friction in doing that. Also, you think about this model, when you’re a platform provider, you also can monetise an ecosystem around that platform. If you think about all the integration partners that these companies have, those are monetised interactions.

Companies that want to interact with the university, many times the university will say, “Fine, but you have to connect with these systems in order to interact with us because you want to drive services and we let those systems control who gets what service, and what they are.” You look at integration fees, you can look at transactional fees of an ecosystem. The idea of a platform is a rich, rich ecosystem that you’re gaining a lot of revenue from. That’s how, when I think about these businesses, and when I was at Transact, I was always thinking about how do I grow the ecosystem, how do I bring additional value to the client as well as to other partners, but monetise that interaction?

TB: Over the past three years, what would you have said that the result of those combinations and those elements has led to an average annual market growth of?

SP: I think it’s 11-20%. I don’t think there’s any excuse for any of these companies not to be growing that way, let me put it that way.

SP: The major barrier to entry is the complexity of education. Education has regulations around it. It has interesting policies and practices that you kind of scratch your head, you would never see in the commercial. It’s because of those unique aspects of how they do their job, the convergence of regulation and policy that you need really sophisticated technology and rules engines in order to do that. Many players, big players, have tried to come in and they abandon it. It’s what we call a very nice walled garden. Also, it’s highly community orientated, so once you’re in, you’re in, and they’re very guarded of who comes into the community.

SP: I still think there’s a good amount of upside organic growth and net ARR [annual recurring revenue] upsells. As long as you’re bringing new products to the market, the clients buy them. They just buy them. That’s great, and it’s always easier to sell to a current client than go get a new one. As far as expansion, which you said, I would prioritise, I would go into markets that are most patterned after the US education system, or a corporate campus type environment. I would go there first, because they relate, they look to the United States, they look to other institutions, they look to other corporate campuses for, “What are you doing and what’s that?” I think that is how I would start to segment the market, when I would go outside of North America.

Then, in segmenting that market, I would make some strategic decisions about what countries do I want to go in, and then, if I do, I always like a foothold, so acquiring a strong provider and, again, I told you it’s a very fragmented market, a bunch of point providers. I would look at who’s there, are they technology forward even though they’re small, and do they have any assets within their portfolio that are unique to that market that we would bolt on. That’s how I would look at it, but I would definitely get a cultural foothold with people who know the community, know the country, the language, customs, and everything like that, and try to keep the American folks off the shore there.