Private company intelligence, fast

The PE landscape is more competitive than ever before, and time is of the essence when it comes to deal sourcing and screening.

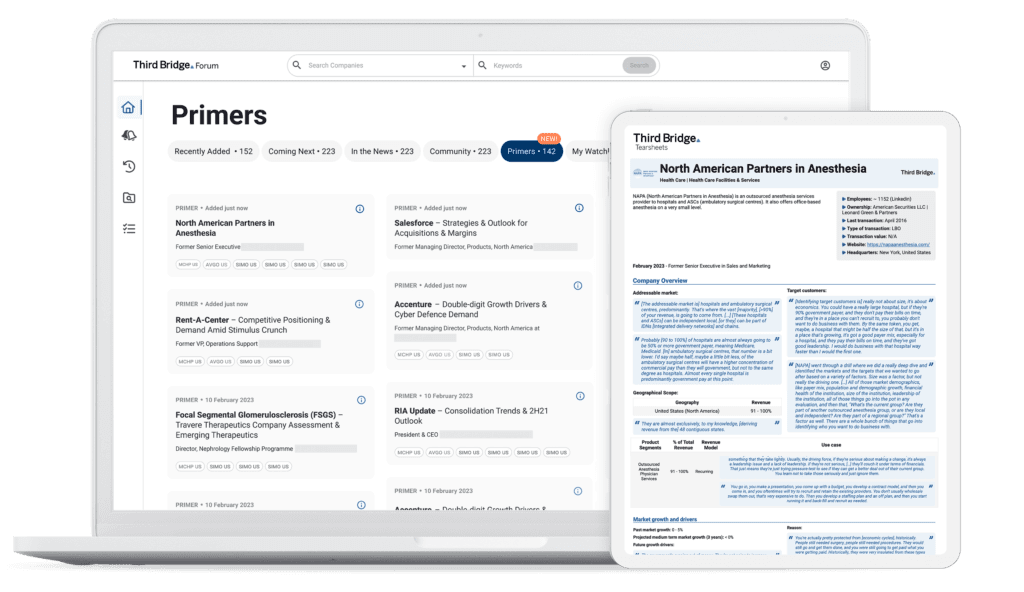

Primers and Tearsheets provide fundamental information on privately held companies from unique human insights, enabling investors to quickly understand a company in early-stage research.

Third Bridge is trusted by 1,000+ clients, globally

We work with some of the world’s largest hedge funds, mutual funds, private equity funds and management consultancies to help them make better investment decisions.

Primers and Tearsheets make the hardest part of the job easy.

Analyst, Global PE fund

Third Bridge is becoming a ‘one-stop-shop’ for all things PE.

Associate, Global PE fund

Primers and Tearsheets replace tedious work that junior team members have to carry out.

Director, Global PE fund

Why Primers and Tearsheets

Primers and Tearsheets offer a new way for investors to source and screen privately held PE and VC-backed companies with ease and speed.

We capture the insights and knowledge from former senior executives who intimately understand a business and its market, providing investors with the key fundamentals of any private company in an accessible format.

Understand the basics of any private company

Piecing together third-party information from disparate sources can be confusing, contradictory and is often incomplete. We do the heavy lifting by leveraging our experts to provide this information.

As a result, clients gain a deeper perspective on the moat of a private company from former executives with previous P&L responsibility, not unqualified ‘outsiders’.

Prioritise relevant companies

Providing quick access to fundamental company information enables our clients to prioritise their screening efforts and dive deeper into relevant companies.

But, we don’t stop there. Our integrated research solutions enable clients to visually navigate between company value chains, collect early-stage intelligence with Interview content or go deeper with 1:1 expert consultations.

Fine-tune due diligence questions

We provide the tools for investors to accelerate and sharpen their understanding of the key due diligence questions in a competitive process.

For example, unearthing new insights about the business model of a company can have a discernible impact on the key follow-up questions for investors during the later stages of research.

Third Bridge Forum clients currently receive complimentary access to Primers and Tearsheets content but may be subject to opt-in.

How clients use our products

Through our approach, clients can quickly understand the basics of a company within minutes, become more efficient at screening and prioritising deals, and uncover new opportunities that may have otherwise gone unnoticed.

Primers and Tearsheets also allow clients to get a head-start by enabling them to fine-tune their questions for follow-up due diligence – saving significant time and resources.

While Primers and Tearsheets will bring efficiencies to our private equity clients, these private company insights will also benefit equity and credit investors.

How Primers and Tearsheets content is generated

Primers content is generated from 1-hour expert interviews focused on gathering fundamental information on PE and VC-backed companies.

Each Primer interview is moderated by a Third Bridge analyst and covers 25 standardised questions with a former company executive who has had P&L responsibilities.

A Tearsheet is a condensed summary of the Primer transcript, which extracts the specialist’s crucial quotes and data estimates. We also overlay company information, such as deal history and senior management, and present it all in an easy-to-read, downloadable format.

Third Bridge integrated research solutions

Primers and Tearsheets are part of Third Bridge’s integrated research solutions for the world’s top investors and business leaders.

No other company in the world provides the same premium holistic offering – combining access to unbiased human insights content with unique investor-led content and a global expert network service.