Stay ahead of the game with our comprehensive private company insights

Our integrated solutions can help you quickly visualise value chains, understand company fundamentals, and dive deep into private company growth potential, competitive landscapes, and more. Request a demo.

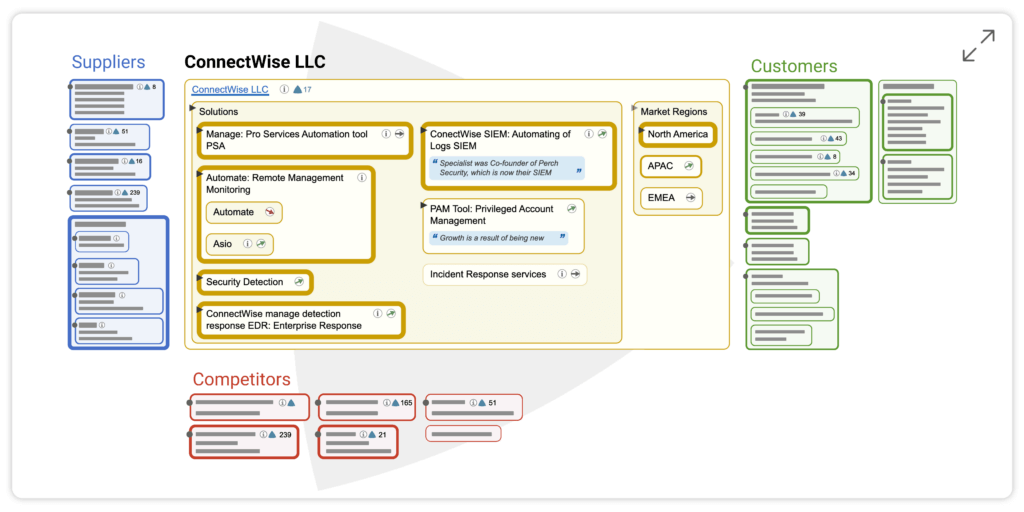

Get an exclusive glimpse into ConnectWise’s value chain map and insightful company information.

The value chain image is generated from Third Bridge Maps

The following transcript is generated from Third Bridge Forum, the biggest archive of high-quality expert interviews in the world, providing investors with critical knowledge to make smarter and faster decisions.

Submit your details to gain access to our premium content and view exclusive answers.

Specialist

Former VP at ConnectWise LLC

Key Insights

- Given the cost-cutting nature this macro environment has induced, the MSP channel, and subsequently ConnectWise, should be fairly well-positioned to managed macro headwinds

- ConnectWise’s valuation is certainly within the USD 6-8bn range, with the specialist noting that when Datto was purchased in June 2022, it garnered the same valuation even though its revenue stream was lower than ConnectWise’s current revenue stream

- Product segments can be broken down into three categories – Manage, Automate and Cybersecurity, with the specialist roughly estimating the revenue split among the three as 40%, 40% and 20%

- Specialist echoes ConnectWise’s relationship ecosystem with its MSP partners as a strength and noted that while churn will always occur, ConnectWise’s net retention has been steadily improving over the past several years

Questions

Transcript

SP: Datto’s valuation was around USD 6bn-8bn also, and if we look at the revenue size of Datto at that point of time when the acquisition happened, it was lower than the current revenue stream that ConnectWise is able to generate. Also, look at the profitability. Obviously the valuation is based on a couple of factors. The cash flow that the company generates, the demand for the products, and obviously there’s no market capitalisation here because this is not a listed organisation, but if I compare it with Datto then I think a valuation of around USD 5bn-7bn is definitely on the cards, I would say. Having said that, this also depends upon the negotiation that happens between the seller and the buyer.

SP: The focus is there, but I don’t have the strategic plan or the strategy that the organisation is adapting to take that route, so I don’t have much information. I shared what I knew.

Gain access to Premium Content

Submit your details to access up to 5 Forum Transcripts or to request a complimentary one week trial.