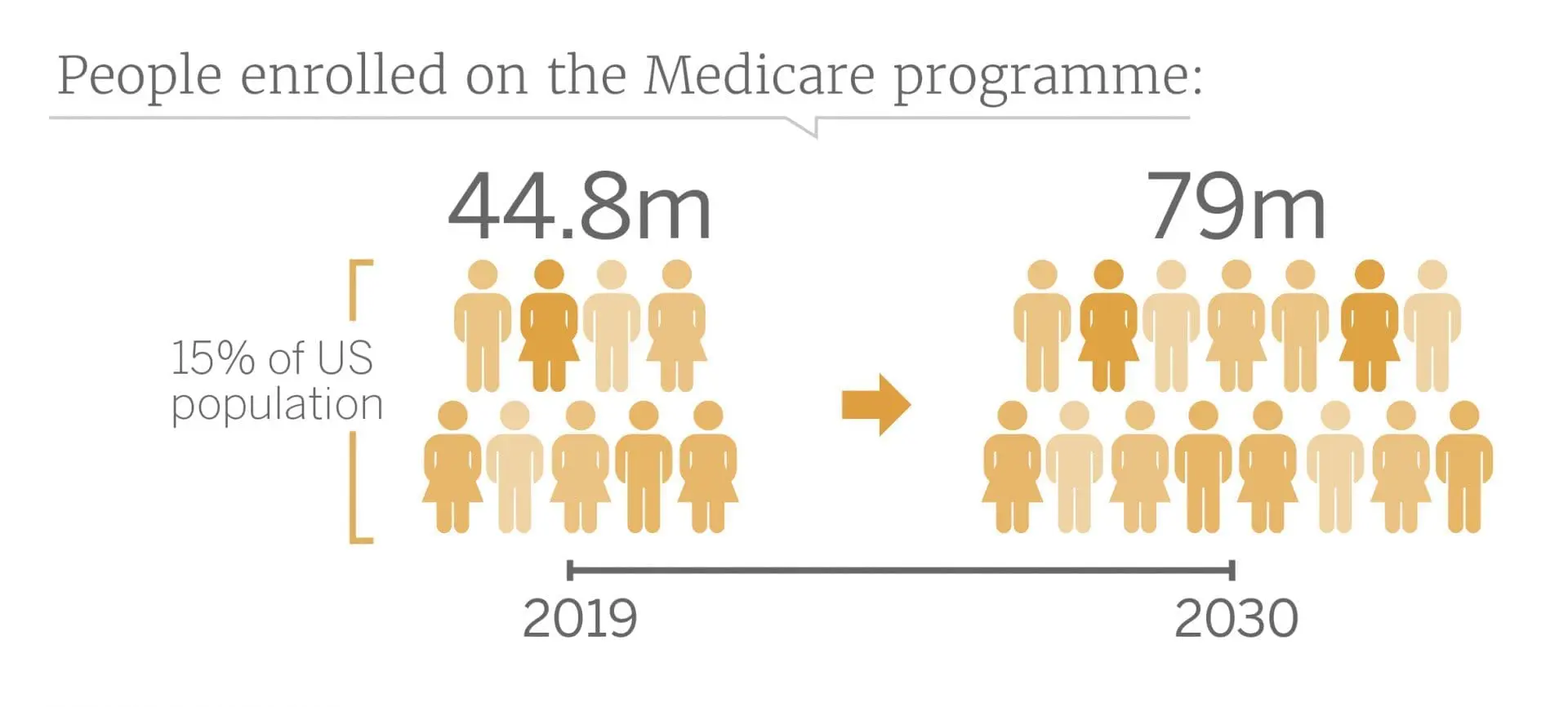

Medicare is a federal insurance programme providing health coverage to US citizens aged 65 and older. Over 44.8 million – the equivalent of 15% of the US population – are enrolled on the programme, and this figure is projected to soar to 79 million by 2030. Medicare helps seniors improve their quality of life, effectively ensuring that patients most at risk of suffering from a chronic condition have the necessary health insurance coverage. Similarly, Medicaid is a state-run, government-funded programme aimed at low-income individuals and families under the age of 65.

By combining these programmes, eligible patients can receive “cradle-to-grave” subsidised healthcare insurance by beginning on Medicaid and transitioning to Medicare at age 65. Unsurprisingly, the demand for healthcare directly correlates to the number of people enrolled on subsidised healthcare plans. Given the continual uptick in the volume of government-funded programmes, the current physician shortage – which research dictates is only set to worsen in the future – is a significant issue for supplying increased demand. Thankfully, consumers’ increased dependence on computing devices has highlighted a potential alternative solution: telehealth. A number of companies, including Doctor on Demand, Teladoc Health and American Well, specialise in designing outpatient care technologies that enable remote examinations. The increasing adoption of medical internet of things (IoT) devices – installing internet connectivity into everyday, offline objects – allows online physicians to monitor key health indicators, such as heart rate or blood pressure, without direct access to the patient. Effectively, these telehealth devices could help diagnose earlier, preventing condition escalation. These telehealth devices stop patients having to regularly attend physical appointments to check vitals as the medical IoT devices would perform the task and only alert care practitioners if health indicators are at unsafe levels. This decreases the number of hospital or private practice inpatients, thereby relieving pressure on the physician workforce.

However, our coverage of the market has repeatedly raised questions around whether older patients would be comfortable using this technology. The eldest members enrolled in Medicare, i.e. those born prior to 1940, undeniably missed the internet generation and tend to rely on hands-on care. However, Third Bridge believes the telehealth market should expect to see an upswing in technological adoption as baby boomers age. Although this generation may not have been born into a connected world, they have been exposed to data-enabled devices and are constantly searching for convenient solutions.

Arguably, UnitedHealthcare, a for-profit insurance and healthcare products company, also believes in the longevity of telehealth services. Supposedly, the company is investing in a toolset built from Teladoc’s technology that would plug directly into the electronic health record (EHR), which it is planning roll-out to the 60-70,000 participating healthcare providers in its network. This would enable healthcare professionals to offer patients real-time, secure telehealth consultations directly from their office. If this were to happen, UnitedHealthcare would gain the advantage of being able to use its existing doctor network to service patients remotely instead of relying on a dedicated database of telehealth physicians. Furthermore, using telemedicine services would help improve efficiencies in an increasingly time-pressured era for physicians by eradicating time wastage caused by cancellations and alleviating the need for appointed time slots even for brief consultations.

While outsourcing via telehealth may seem like a sensible solution to the physician shortage, an ageing population on the diagnostic side of the device may pose a roadblock. The success of telehealth companies is not only dependent upon patient adoption but also on the buy-in of physicians and specialists. According to our market analysis, 43% of doctors in the US are over the age of 55, a quarter of whom are not utilising electronic records or are resistant to adopting the global risk model, which telehealth lends itself well to. The global risk model is being used at increasing frequency for Medicare plan providers, such as Humana and UnitedHealthcare, as a way of shifting their exposure from the patient to physician-management companies like WellMed. The model accomplishes this by enabling plan providers to pay a fixed, monthly, all-encompassing amount to the likes of WellMed instead of reimbursing them per patient consultation. As a result, there is more pressure on physicians to prevent expensive rehabilitative stays by keeping members healthy. Companies such as newcomer ChenMed are encouraging monthly preventative check-ups to prevent serious illnesses. However, this may result in physicians cutting corners to stay within budget in the short term.

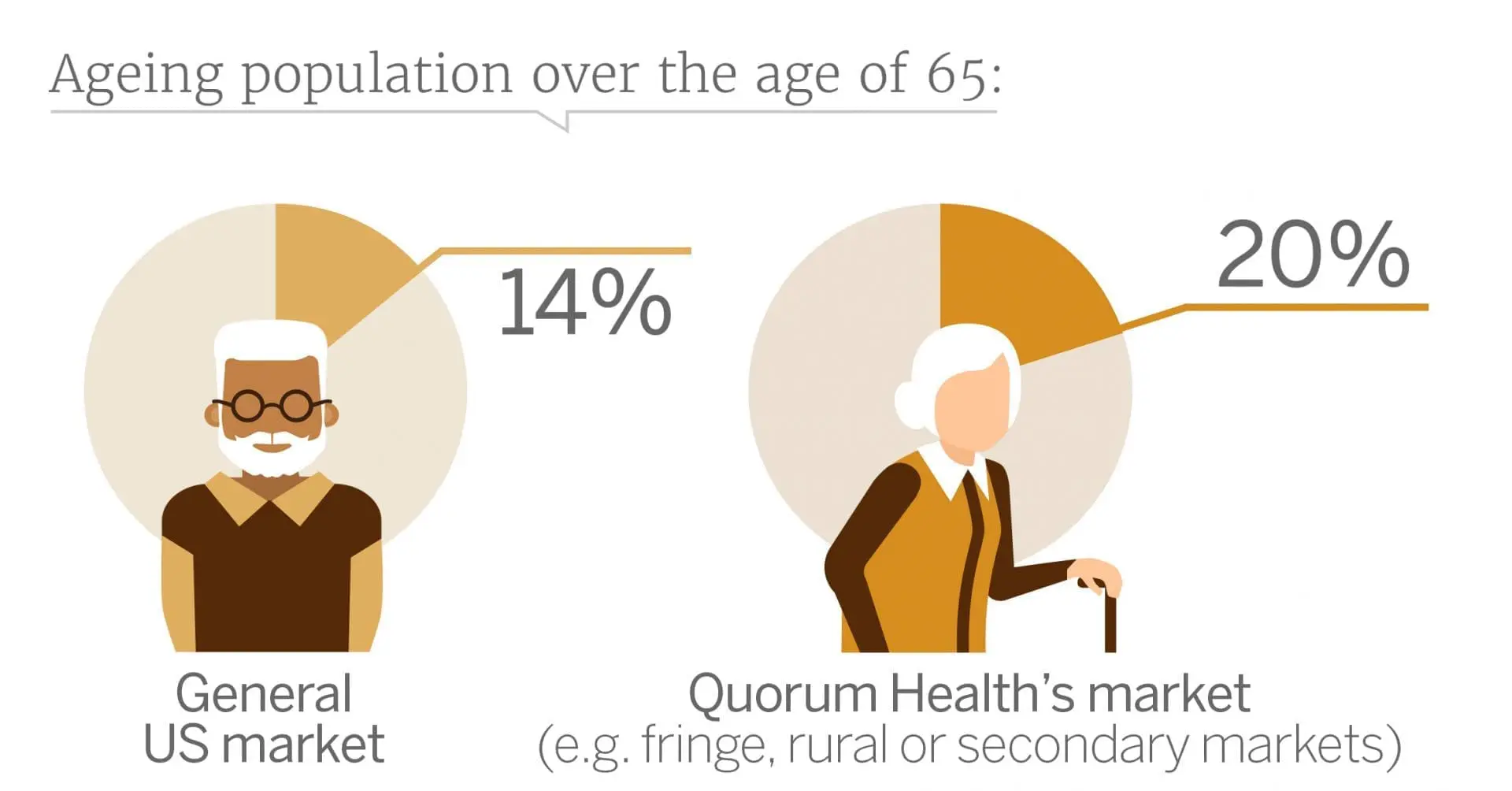

These telehealth advancements could be disadvantageous for brick-and-mortar healthcare companies like acute care hospital operator, Quorum Health. Quorum’s portfolio is largely situated in rural, secondary or fringe markets, all of which have recently seen a high number of hospital closures. This is because government policies like Medicaid and Medicare do not allow hospitals to recoup the costs involved with patient care, so hospitals only receive approximately USD 0.87 per USD 1 spent. These brick-and-mortar companies operating in areas with a high density of government subsidised insurance plans, such as Quorum, could suffer as physicians seek to reduce the need for expensive treatments or diagnostic procedures administered to inpatients to stay within their global risk budget. While Quorum is attempting to improve profit margins by closing some of its hospitals, even if it is able to survive beyond the next five years, with the baby boomer generation turning to government-funded plans and the increase in telehealth utilisation rates by plan providers, Quorum Health’s bottom line will likely continue to suffer.

The information used in compiling this document has been obtained by Third Bridge from experts participating in Forum Interviews. Third Bridge does not warrant the accuracy of the information and has not independently verified it. It should not be regarded as a trade recommendation or form the basis of any investment decision.

For any enquiries, please contact sales@thirdbridge.com