Insulin pumps, which methodically deliver insulin into an individual’s blood, have historically been aimed at type 1 diabetics, who account for around 10% of the market. Some 30% of patients with type 1 diabetes in the US use an insulin pump – “and I think it’s growing”, a former VP at Becton Dickinson & Co told us. However, “there is only so much market share you can pick up from those” and companies have started looking for new growth areas. With rising cases in type 2 diabetes, this “is an obvious start”. A former VP at Medtronic said the emergence of automated insulin delivery systems – such as Control-IQ, Medtronic’s 780G (pending regulatory approval) and Omnipod 5 – is exciting but “when you start looking at type 2 it’s a completely untapped potential”.

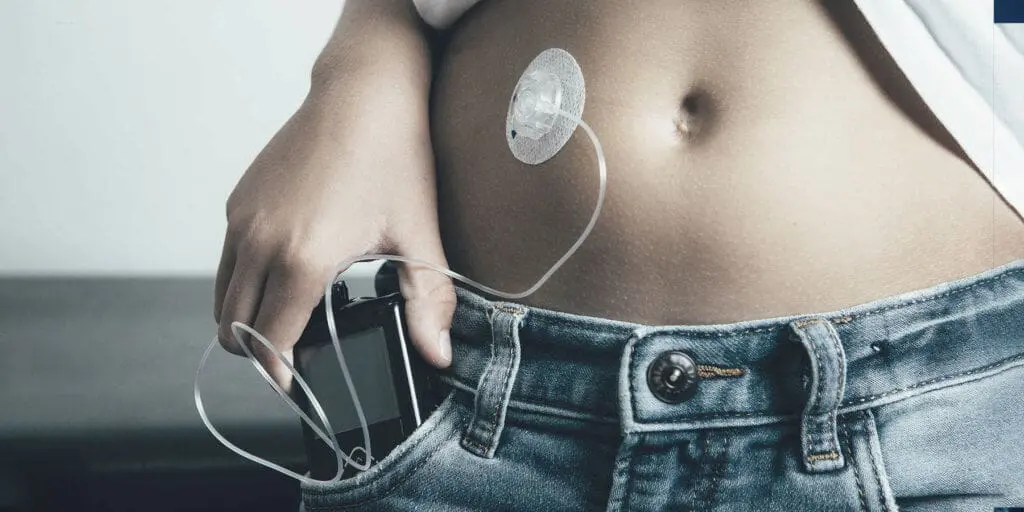

Insulin pumps that were designed for type 1 patients require pump manipulation for dose adjustments and are therefore “too cumbersome” for type 2 patients. “So that’s where the opportunity for patch pump actually does play out”, the former Becton Dickinson & Co VP said. The expert added that Omnipod has signalled it is shifting towards type 2, and Becton Dickinson is “talking pretty much exclusively about type 2”. Given the much larger size of the type 2 diabetes market, the revenue opportunity is “double if not triple” the size of the type 1 market, despite the projected lower penetration rate in the type 2 market.

However, we were told that type 2 is a price-sensitive market that is scrutinised more by payers – and this has been exacerbated by squeezed healthcare budgets after COVID-19 and the current macroeconomic environment. “You cannot go with thousands of dollars per device, so you really need to become much more price-sensitive.” The industry is responding by pushing for a reduction in the costs of goods sold as well as simplifying systems. “If you look at the strategy of Becton Dickinson, they are going for simple, cheap devices,” our expert said. “That’s the idea, and specifically because they are trying to make them reimbursable in the type 2 patient population.”

We also heard about opportunities in “closed-looped pumps”, which do not require user input and are sometimes referred to as an artificial pancreas. Developments here tie into the trends of insulin delivery automation and connectivity, including remote patient monitoring. Continuous glucose monitors (CGMs) are increasingly standard-of-care and enabling advancements towards hybrid closed-loop systems and full closed-loop systems in the type 2 market. “That’s probably the biggest growth opportunity,” the former Becton Dickinson VP said.

Hybrid closed-loop pumps deliver automated basal insulin using an algorithm and real-time CGM monitoring, an approach that still requires some input from the user. But open-loop pumps are becoming “a thing of the past”, we heard, thanks to the democratisation of CGM. Sensors are becoming more reliable, with better wearability and a higher level of precision, we were told. “[In] CGM, right now, look at the penetration of Libre [FreeStyle® Libre]. In type 2, it’s huge, and I can see Dexcom following that trend pretty quickly.” Ultimately, our expert sees the penetration of hybrid and full closed-loop pumps “growing significantly” over the next 4-5 years.

However, there are several important considerations. “The question is detecting the meal and kicking in insulin in time that it can act, or, on the flip side, detecting a drop and suspending delivery,” the former Becton Dickinson VP said. Clinical trials are showing promising results, but getting the green light from the FDA will be no easy feat, given the stringent efficacy and safety requirements. Another issue is that personalising systems requires AI-adjusting algorithms, which we were told the FDA “does not like” because they are not “transparent”. Lastly, the specialist we interviewed highlighted that medical intervention when something starts to go wrong is a crucial consideration, because in a full closed loop there is no designated point of control.

Forum Interviews also discussed the FDA’s warning letter to Medtronic in December 2021 for not appropriately classifying patient risk for faulty MiniMed insulin pump devices or initiating a recall for such devices. The former VP at Becton Dickinson does not believe the letter tarnishes Medtronic’s reputation “beyond recovery” and that what has hurt the company more is its Guardian CGM sensor, which they said was inferior to Dexcom’s. In the Interview with the former VP at Medtronic, we were told the company has experienced “product catch-up issues” as well as manufacturing challenges regarding this device. However, they said they do not doubt the company’s ability to resolve the FDA warning letter, noting that “these things take time”.

Both experts were bullish on Medtronic’s overall competitive positioning, with the former VP at Medtronic saying they see it as the only company with a well-entrenched footprint in the diabetes insulin pump and CGM space, as “many companies have come and gone.”

The information used in compiling this document has been obtained by Third Bridge from experts participating in Forum Interviews. Third Bridge does not warrant the accuracy of the information and has not independently verified it. It should not be regarded as a trade recommendation or form the basis of any investment decision.

For any enquiries, please contact sales@thirdbridge.com