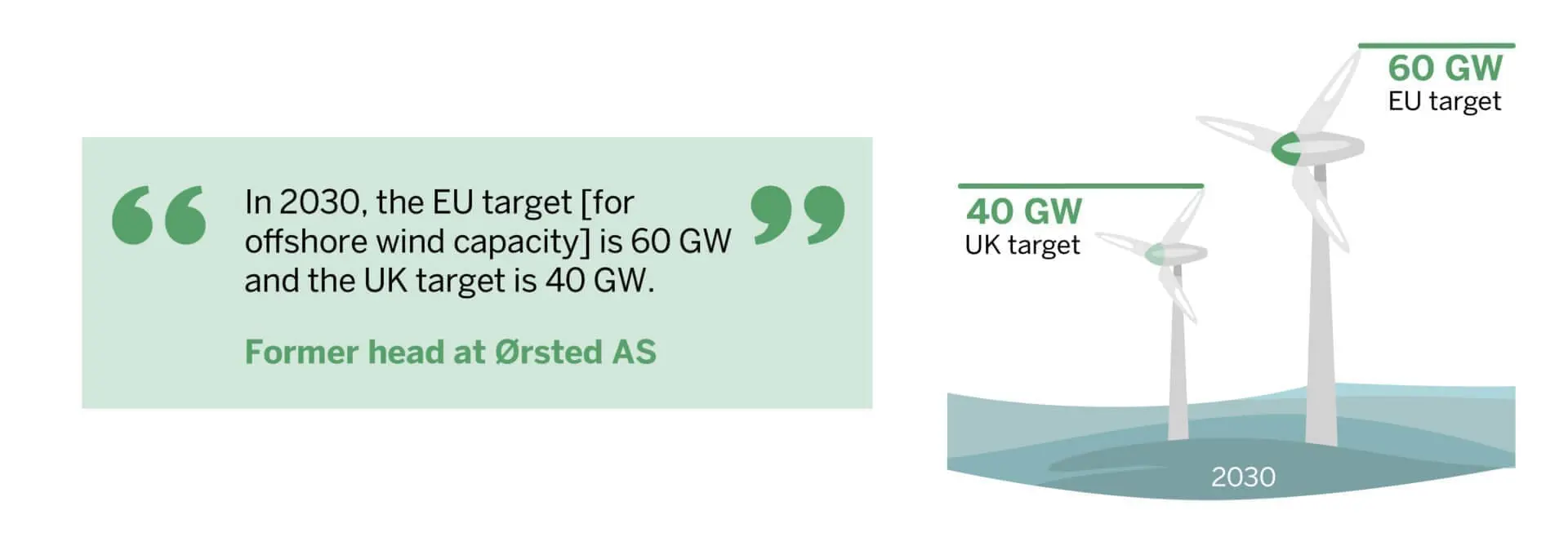

Offshore wind’s potential is starting to be realised. With the EU aiming to install 300 GW of offshore wind capacity by 2050, there is “no turning back” for this source, commented a former head from Ørsted AS. Relatively more near-term, by “2030, the EU target is 60 GW and the UK target is 40 GW”. The specialist pointed out that, with Brexit taking away the UK’s previous contribution to the EU’s capacity, “innovative solutions” are a necessity. Denmark’s artificial wind farm is one example of what these could look like. The project, with one cluster of turbines situated on a natural island in the Baltic Sea and another on an artificial island in the North Sea, will provide a total of 5 GW and already has plans to be expanded in future.

Indeed, another specialist, a former C-level executive at TPI Composites Inc, agrees about offshore’s breezy prospects, stating that it “is important to watch”. They brought attention to the fact that “onshore still has a cost advantage, but I think the offshore market has really surprised me in its ability to drive cost out.” Another factor working in offshore’s favour is that “it’s much closer to the load centres. It’s offshore to a large part of the major coastal cities. You’ve got a critical and expensive infrastructure to build to connect it in, but once you do, you’re right there at the load.”

One of the major developments in this space in recent years, and the latest in green energy

trends, has been the entry of oil companies. With falling fossil fuel prices and significant asset write downs, added to global agreements to reduce carbon output, oil companies are on the lookout for new revenue streams. In addition, many of these entities have made ambitious green commitments – for instance, by 2050, Shell aims to be net zero, while Eni, aiming for net zero by 2030, wants to reduce net lifecycle emissions by 80% by 2050. Several majors have already set their sights on wind. As noted by the former Ørsted executive, BP’s partnership with the Equinor field is indicative of their “clear ambition” to attain carbon neutral status, especially in light of the fact that “offshore wind is a key technology to [achieve] that, but it’s not that simple to start building from scratch”. The agreement includes jointly developing four assets in two existing leases and pursuing other opportunities in the US market.

But what could this mean for existing players in the wind space? “With the introduction of the oil majors, they crowded out some of the smaller players due to the capital intensity when they [started] paying huge amounts of sums for some offshore wind leases.” There could also be implications for pricing, not just in auctions but also for site leases. “Of course, competition drives prices down, and with the introduction of oil majors, there’s been a huge increase in competition, but I think the competition was even there before”, summarised the former TPI Composites executive.

With wind power taking off, suppliers will be in high demand. The former TPI specialist explained that most wind turbine OEMs self supply, and aside from these there are two major global players, TPI and LM Wind Power, which was acquired by GE. China “really seems to be distinct”, in that domestic companies have little international success, but dominate within the country – which in itself has a burgeoning offshore wind power market. Looking more specifically at notable models, two specialists mentioned GE’s Haliade-X, which was the world’s most powerful turbine when released in 2019. However, according to the Ørsted executive, it has competition: “Siemens Gamesa came out with a 14-megawatt turbine now. Now GE is not to be the biggest kid on the block any more.” GE has since configured an updated 13 MW version, which is being trialled.

Aside from offshore wind, other forms of energy are starting to receive more attention. Geothermal has historically received the cold shoulder. Previously viewed as complicated and expensive to initiate, technological advances – partly spurred by those made in hydraulic fracturing – are reigniting interest. Third Bridge Forum learned more about how this sector is taking off in the Philippines, which is one of the world’s leading geothermal hotspots. As of October 2020, the country changed its regulations to allow 100% foreign ownership in geothermal energy projects with an initial investment exceeding about USD 50m.

A senior executive at Aboitiz Power Corp commented on how this change could trigger additional investment in different geothermal project types: brownfield, greenfield and, in their view “potentially very significant”, challenging geothermal fluids opportunities. In this latter category, these wells had promising flow and heat content, and “the geotechnical science which has developed over the years may perhaps have some solutions which could make some of those assets more valuable today than what they were originally gleaned to have, because of the fluid characteristics.”

There are some uniquely challenging aspects to this source of energy, though. While there’s a lifetime of about 30 years for a project, “there’s a degradation of performance of those steam wells over time. That degradation rate can be in the range of 4-5%, it can be also as high as 7% or 8% per year.” This differs from oil and gas, in which there are different techniques used to stimulate the wells, they explained. In addition, “it’s steam from the earth, it’s not from a boiler, it’s not high-quality steam. It actually plays havoc and causes a lot of additional maintenance concerns and challenges on the steam turbines that also will need to be upgraded over the years or they may lose their capacity.”

With the urgent need to accelerate uptake of cleaner energy, it is imperative that all sources and new technologies are explored. By moving into new frontiers and green energy trends, we can lessen the impact that the energy industry has on the environment and work towards a greener future.

The information used in compiling this document has been obtained by Third Bridge from experts participating in Forum Interviews. Third Bridge does not warrant the accuracy of the information and has not independently verified it. It should not be regarded as a trade recommendation or form the basis of any investment decision.

For any enquiries, please contact sales@thirdbridge.com