Following the fatal Lion Air and Ethiopian Airlines accidents in October 2018 and March 2019 respectively, the Boeing 737 MAX has been grounded in over 50 countries. While the direct cause of the incident has not yet been confirmed, it has been widely suggested that the accident occurred from a faulty sensor, which incorrectly reported that the aeroplane was stalling. This triggered the automated system known as the Manoeuvring Characteristics Augmentation System (MCAS), which pointed the nose of the aircraft down in an attempt to correct the alleged stall. Although trained pilots were operating the 737 MAX at the time, they had not been warned about the fault and no mention of MCAS had been included in the flight manual despite the company allegedly being aware of the issue prior to the incidents. As a result, the FAA has launched an extensive investigation and has already uncovered a number of flaws in the aircraft certification process, which have been exacerbated by a shortage of qualified regulators. This investigation has caused the market to question how long it will take before the issues are rectified and the plane is commercially relaunched.

Additionally, if a flaw with the hardware of the plane is found, this would inevitably lead to Boeing having to change other aspects of its physical makeup. This is because even the smallest structural changes can cause aircraft failure. Even without this occurring, there are a number of hurdles that Boeing would have to overcome before the 737 MAX is placed back in service. For instance, the evident lack of pilot training or awareness of the MCAS that contributed to the accidents places pressure on pilots to undertake additional training. In the worst-case scenario for Boeing, pilots would have to attend costly training sessions using simulators that recreate the MCAS fault to ensure professionals know how to react if the fault recurs.

The number of 737 simulators is limited and they are generally located in North America and Europe. Consequently, this is likely to cause a bottleneck in key markets such as China, which previously accounted for 20% of worldwide deliveries for the 737 MAX. If, when the FAA’s investigation ends, pilot groups or regulators in China require pilots to undergo simulator training, pilots who do not have access to a 737 simulator in their country would have to find facilities that do. Considering simulators only function twenty hours a day and are generally regarded as 3-5 times more expensive and time-consuming than computer-based training methods, this would delay the reintroduction of the 737 into one of Boeing’s main markets.

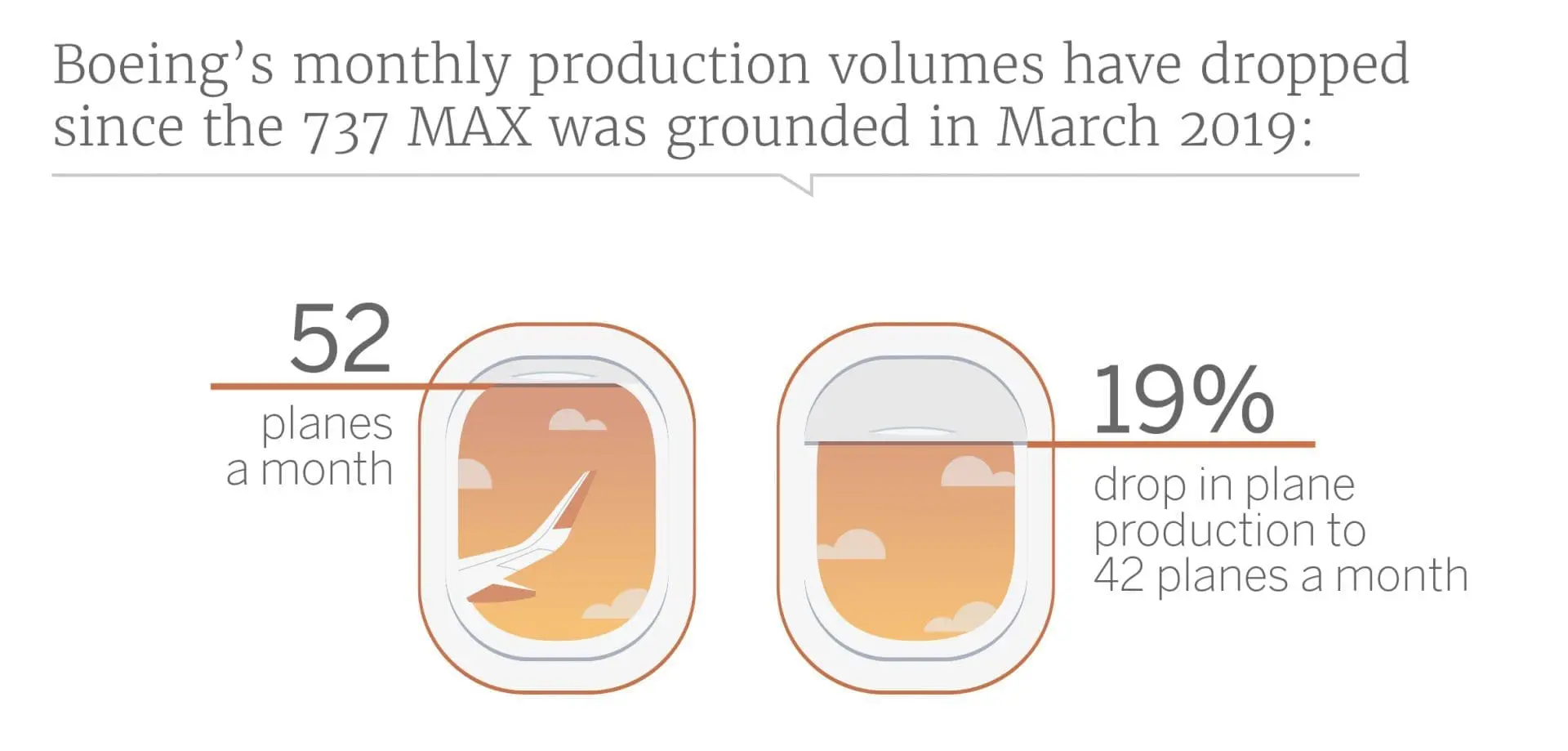

As a result, while research shows that some remain optimistic about Boeing’s ability to recover, the general consensus is that this will take longer than anticipated, with key specialists saying that Boeing will not be able to regain market value until early 2020. Boeing has already reduced production rates of the 737 MAX from 52 aeroplanes per month to 42, and this is where the situation begins to affect Boeing’s suppliers and component manufacturers. This is particularly true for suppliers that depend predominantly on aerospace manufacturing – and, even more specifically, the 737 – for revenue. A primary, example of this is Spirit AeroSystems (Spirit), the world’s largest first-tier aerostructures manufacturer. Spirit generates more than 78% of its profits from Boeing, and despite reporting strong first-quarter results in late April, the company’s share price has plummeted by 24% from a high of USD 99.35 to its current position around USD 75.45 since the grounding of the 737 Max jets. Spirit AeroSystems has tried to rectify this loss by lowering worker hours to cut costs, reducing the workweek to 32 hours for commercial focused, salaried, management and executive employees. These cuts impact salaries by 20% per week, totalling approximately USD 13 mn. in savings across the 10-week period permitted by the Wichita Technical and Professional Unit and Wichita Engineering Unit contracts.

Alternative tier-one suppliers such as Curtiss-Wright, which have a diverse portfolio of projects unrelated to the 737, may find that this situation places them in a strong position if there is a prolonged halt in productivity for the 737 MAX. Having faced reduced margins and delayed payments from Boeing for the past 2-3 years, the companies could effectively use the situation as leverage to negotiate their ill-treatment with the Boeing. Previously, the power dynamics had categorically favoured Boeing, particularly after it began its initiative to cut costs, which Boeing called ‘Partnering for Success’ but suppliers called ‘Pilfering from Suppliers’. Boeing’s control over the aviation market has created substantial criticism of the company, with some suggesting that its monopolisation allowed it to get away with the 737 MAX faults. As a result, suppliers could be emboldened to push back against cost-saving initiatives.

Ultimately, the market expresses optimism towards tier-one companies with a diverse portfolio of clients. However, it questions the extent to which companies at the bottom of the supply chain will be able to survive. This is especially true if there are further delays to the aircraft becoming flightworthy, as has been projected.

The information used in compiling this document has been obtained by Third Bridge from experts participating in Forum Interviews. Third Bridge does not warrant the accuracy of the information and has not independently verified it. It should not be regarded as a trade recommendation or form the basis of any investment decision.

For any enquiries, please contact sales@thirdbridge.com