Data show the stark regional variety of impacts. Sales collapsed, a former senior executive from Punch Taverns Ltd told Third Bridge Forum, citing CGA data, with tier 1 down by 27%, tier 2 by 54% and tier 3 by 62% on a YoY basis at one point last October.[mfn]https://www.thespiritsbusiness.com/2020/10/on-trade-spirits-sales-fall-83-in-tier-three-areas/[/mfn] There was, again, disparity according to where these pubs are located, as a director at EI Group plc explained: “city centres have been the victims of this pandemic, because, even today, large city centres are half the places that they were before. Interestingly… community suburban pubs recovered quite quickly.” Pubs have been disappearing at a high rate over the past decade — 914 in 2018 and 994 in 2019 — and this will be exacerbated by current conditions. “My estimation is circa 2,000 pubs will be lost from the industry over the next 12-18 months, probably nearer 18 months”, stated the EI Group executive.

While visits are down across the country, the rules have altered visit dynamics. “The suggestion is that, because the impulse event has now become a planned event, the dwell time has increased for individuals. They want to stay there for longer, they want to enjoy the event, and spend per head is actually up as much as 30%”, said the director. One issue expressed by both these specialists is the confusing and ever-changing rules, which is detrimental to consumer confidence, especially among the over 30s.

Government support has been vital to many industries, and pubs have been able to tap into this. Across the UK, this has included furlough and loan schemes, but there are some differences across devolved administrations. The business rate saving has been “significant”, as the former Punch executive detailed. “The business rates payable for a pub is probably going to be their second-biggest number behind rent. In some cases, where revenue in a pub is really good, it could be more than the rent payable. It could be GBP 20,000 a year, payable for a pub… on [a] rateable value of GBP 45,000- 50,000.”

What remains to be seen is what will happen regarding VAT. “When 1 April comes along, if the government [doesn’t] increase that VAT reduction for another few months, then businesses are going to have a big crunch point in April… That’s a real big thing.” Another upcoming issue is the review on beer duty, for which feedback is being analysed at the time of writing. “I’m not sure, politically, the government really want to reduce beer duty when there’s going to be lobbies and campaigners arguing against that on health benefits. I can see the government saying, “We’ll freeze beer duty”, or actually, they’re looking at a review to see how they can make it more equitable and fairer across all of the major brewers.”

Not only is revenue hugely disrupted, but operational costs are also spiking. Sanitising and PPE, among other additional expenses, “[are] costing some of the bigger pubs as much as GBP 400 per week, but I think it’s about GBP 60-70 per week… on average”. Installing acrylic glass, which has also been in high demand, is costing pubs about £1,000 on average. To summarise, “on the one hand, reduced sales mean that you need fewer people in the pub, but on the other hand, the conditions that are applied mean that the activity that’s performed is less efficient and more labour intensive.”

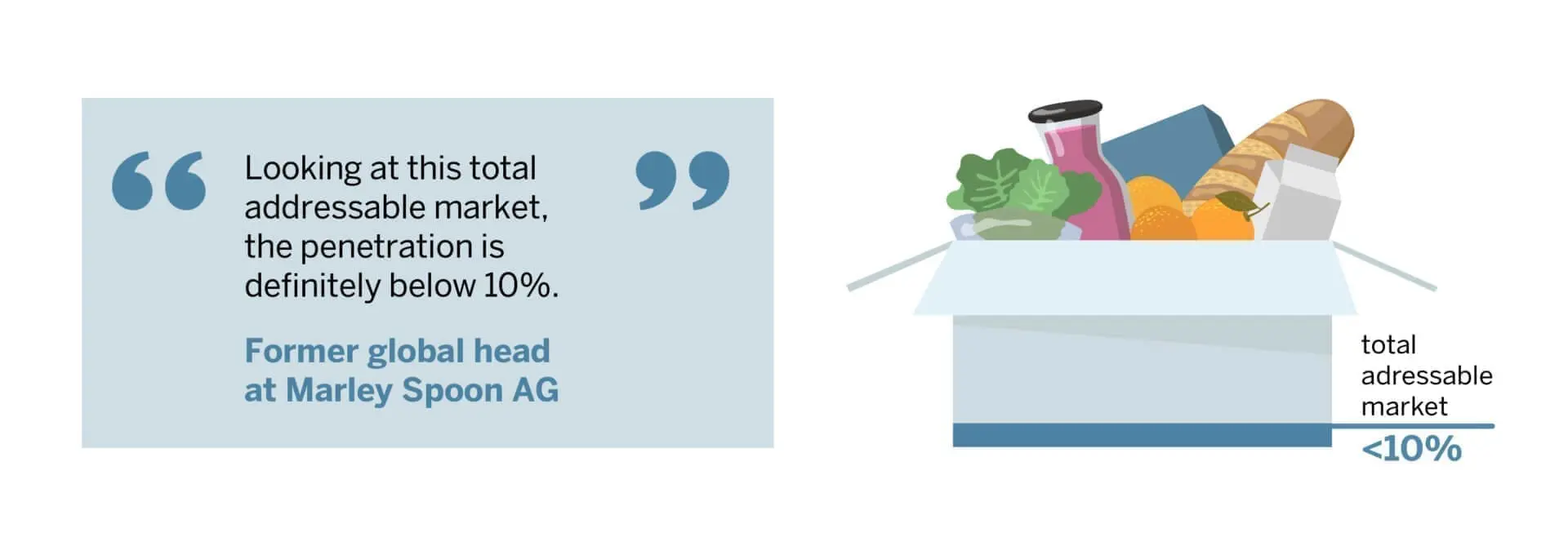

Staying in hasn’t stopped people from wanting to try new things — and this is reflected in sales of meal kits heating up over the past year. “Growth was actually double what has been planned”, said a former global head at Marley Spoon AG. Whereas, previously, this “young” industry had high customer acquisition costs and spent more time explaining their service to prospects, COVID-19 has hastened uptake: “This switch from this offline to online was growing faster than expected, but actually [COVID-19] was not fundamentally changing any trend, just people actively looked.”

While there is a vast total addressable market — out of which our specialist estimates that just 10% has been penetrated — the potential varies across Europe. “For example, Germany is a challenging market, because people… are super price-sensitive”, whereas the UK seems to be much more open. Mindful Chef saw sales surge by over 400% in May from end-March, while Gousto temporarily stopped taking on new customers and hired 400 new people to meet demand. Looking outside of Europe, the former head pointed to the US and Australia as other examples of “where the customers tend to accept a new product easier”.

There are some challenges for companies working in this space. What is essential, the specialist explained, is logistics partners that can deliver the parcels chilled and in specific time slots — “that’s also one of the reasons why the Netherlands are running better, because it’s a comparable small country with a lot of people but better delivery infrastructure.” Another vital ingredient is ensuring that kits are fully customisable and can be adapted to different dietary requirements.

A pertinent question for companies affected by COVID-19 restrictions is whether these consumer shifts will remain. There seems to be evidence that meal-kit uptake could last, while our specialists are optimistic on consumers heading back into pubs, as witnessed during summer 2020. “The demand is 100% there, without question. The two things holding people back are capacity and confidence.”

The information used in compiling this document has been obtained by Third Bridge from experts participating in Forum Interviews. Third Bridge does not warrant the accuracy of the information and has not independently verified it. It should not be regarded as a trade recommendation or form the basis of any investment decision.

For any enquiries, please contact sales@thirdbridge.com