European Private Equity expecting a hectic year ahead

Are we about to see a rise in the number and value of acquisitions made by European PE firms?

Despite the war in Ukraine, frayed supply chains, and soaring inflation levels the European Private Equity (PE) industry expects a busy year ahead according to a forecast survey undertaken by investment research firm Third Bridge and M&A specialist, Mergermarket.

In a survey of mid-cap PE firms, most respondents expected the level of new acquisitions they make to increase (54%) or stay the same (32%) in the coming year. Larger mid-market funds were more likely to expect their number of deals to increase: 42% of respondents whose last fund was worth €500m or more anticipate a ‘significant increase’ in the number of acquisitions they make next year (26% expect a slight increase while 26% say it will stay the same).

Explaining the results, Joshua Maxey, co-founder of Third Bridge said:

“Private equity is extremely well adapted at turning periods of volatility and market dislocation to its advantage. Larger firms are more bullish in the face of adversity thanks to their stores of dry powder and deal pipeline visibility. There is obviously plenty of uncertainty in today’s market but that also means there is an opportunity for private equity investors to enable even stronger value creation for their investors.”

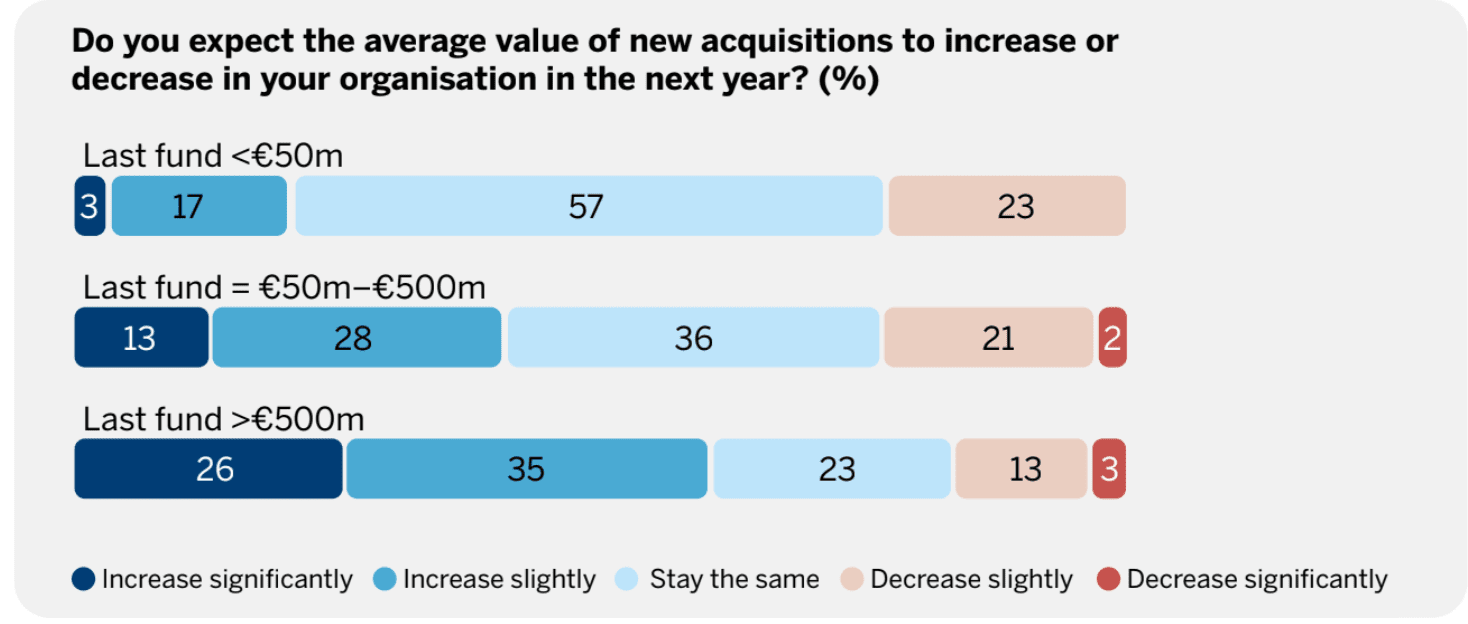

Not only are funds set to make more acquisitions, but they are also expected to be even more valuable. Overall, 41% of respondents said they expect the average value of their new acquisitions in the next year to increase, rising to 61% amongst firms with funds worth €500m+. Breaking this down, around a quarter expect this to increase significantly and another 35% expect it to increase slightly.

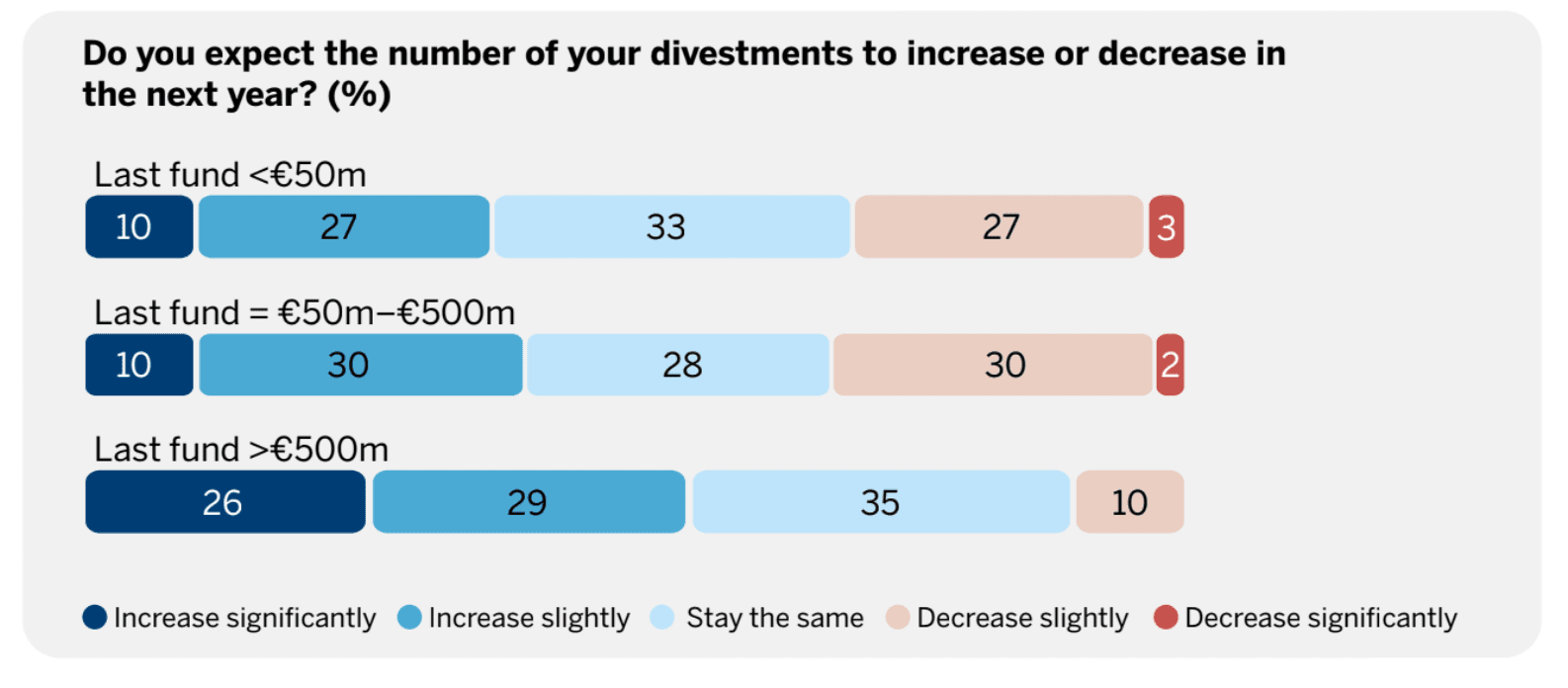

Exits are also on the cards – Turning to the exit side of the PE investment lifecycle, 43% of respondents expect the number of divestments they make in the next year to increase and 31% expect their level of divestments to stay largely the same. There is once again a gulf between larger and smaller sponsors. More than half (55%) of respondents representing funds worth €500m+ expect the number of divestments they make in the next year to increase, including 26% who expect the number to increase significantly.

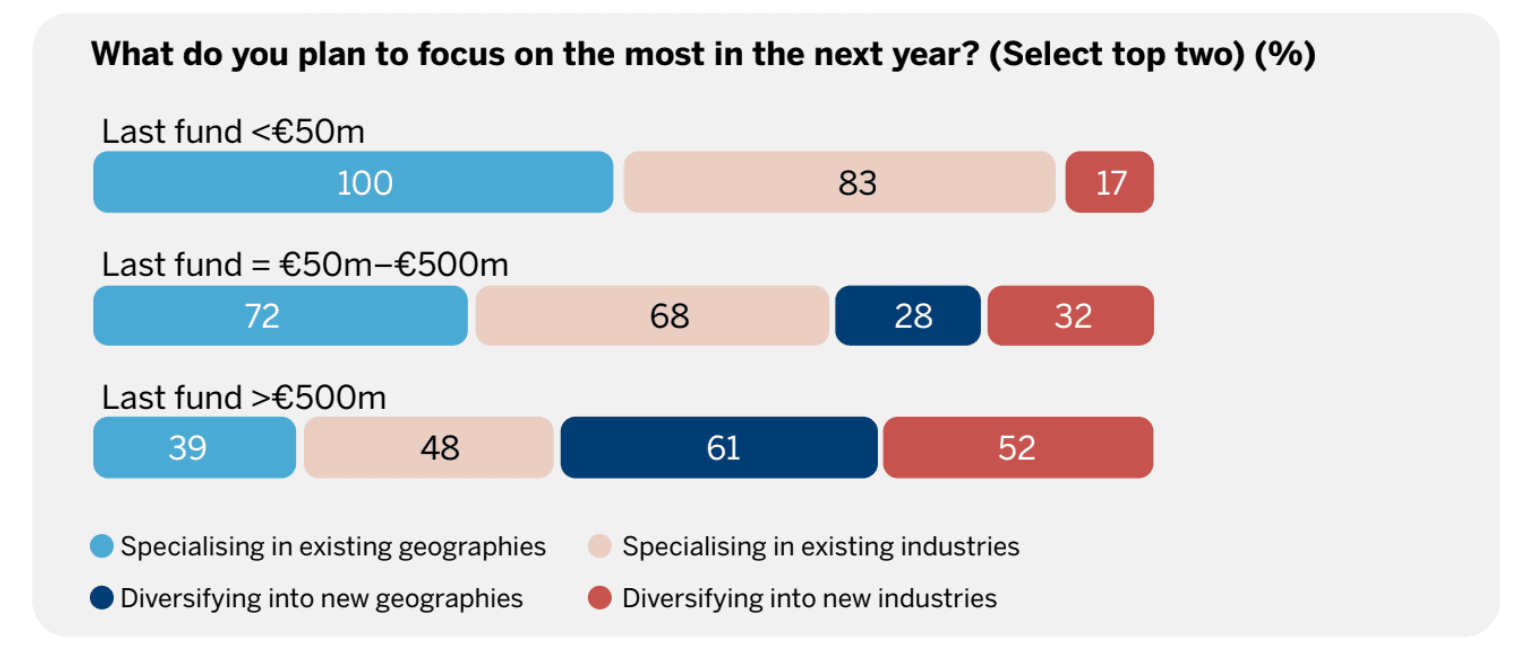

New markets and industries are attracting the attention of larger funds: Overall, 33% of respondents say they plan to diversify into new geographies and 30% say they will diversify into new markets. However, almost two-thirds (61%) of respondents representing firms with funds worth €500m+ plan to prioritise diversification into new geographic markets in the next year, with 52% saying they will focus on entering new industries.

Contextualising the results Joshua Maxey, co-founder of Third Bridge said:

“Private equity’s mission to help companies with value-creation is now front and centre. The lower levels of investor scrutiny and trading noise private companies are subject to means PE is well placed to invest for the longer-term.”

We may be entering a new period of volatility but PE’s deep operational expertise and ability to steward companies through challenging times is about to come to the fore. The seller’s market has now become a buyer’s market. Those with capital available to deploy after 2021’s record fundraising

year find themselves in a strong position.

Ends.

Notes to editors:

Methodology – In the first to second quarter of 2022, Mergermarket, on behalf of Third Bridge, surveyed 114 senior executives from PEs based in core European markets including the UK (23), France (23), DACH region (24), Benelux region (22), and Denmark, is and Norway (22). Thirty PE firms stated their last fund size is less than €50m, 53 stated it was €50m-$500m, while a further 31 stated it is more than €500m. The survey included a combination of qualitative and quantitative questions. All interviews were conducted over the telephone by appointment. Results were analysed and collated by Mergermarket, and all responses are anonymized and presented in aggregate.

About Third Bridge – Third Bridge is a market-leading global investment research firm. We provide unique, human-led insights to some of the world’s largest hedge funds, mutual funds, private equity funds and management consultancies to help them make better investment decisions. We serve over 1,000 investment firms, offering clients 24/7 coverage through our team of 1,200+ employees located across seven offices.