Our Q1 2019 Sector Report analysed that JLR should localise its product offerings, in accordance with consumer demands in each operating country, but more recently the company’s move to do so has now drawn the criticism that they’ve strayed too far from their roots. While the brand has always been associated with classic English style and elegance, the quality issues that have arisen from trying to cater for them in China have seemingly damaged JLR’s brand.

Tata Motors-owned JLR recently entered into a joint venture (JV) with Chery to produce vehicles within Changshu for China-based consumers. However, specialists believe that this JV is the reason that around 100,000 units have been recalled in the past year – a number equatable to the company’s total Chinese sales volume in 2018. Although this move was made to strategically localise JLR’s offering by teaming with a local manufacturer, Chery’s reputation for producing quality is relatively low and this unfortunately led to a deterioration in calibre and a nose-dive in terms of units sold.

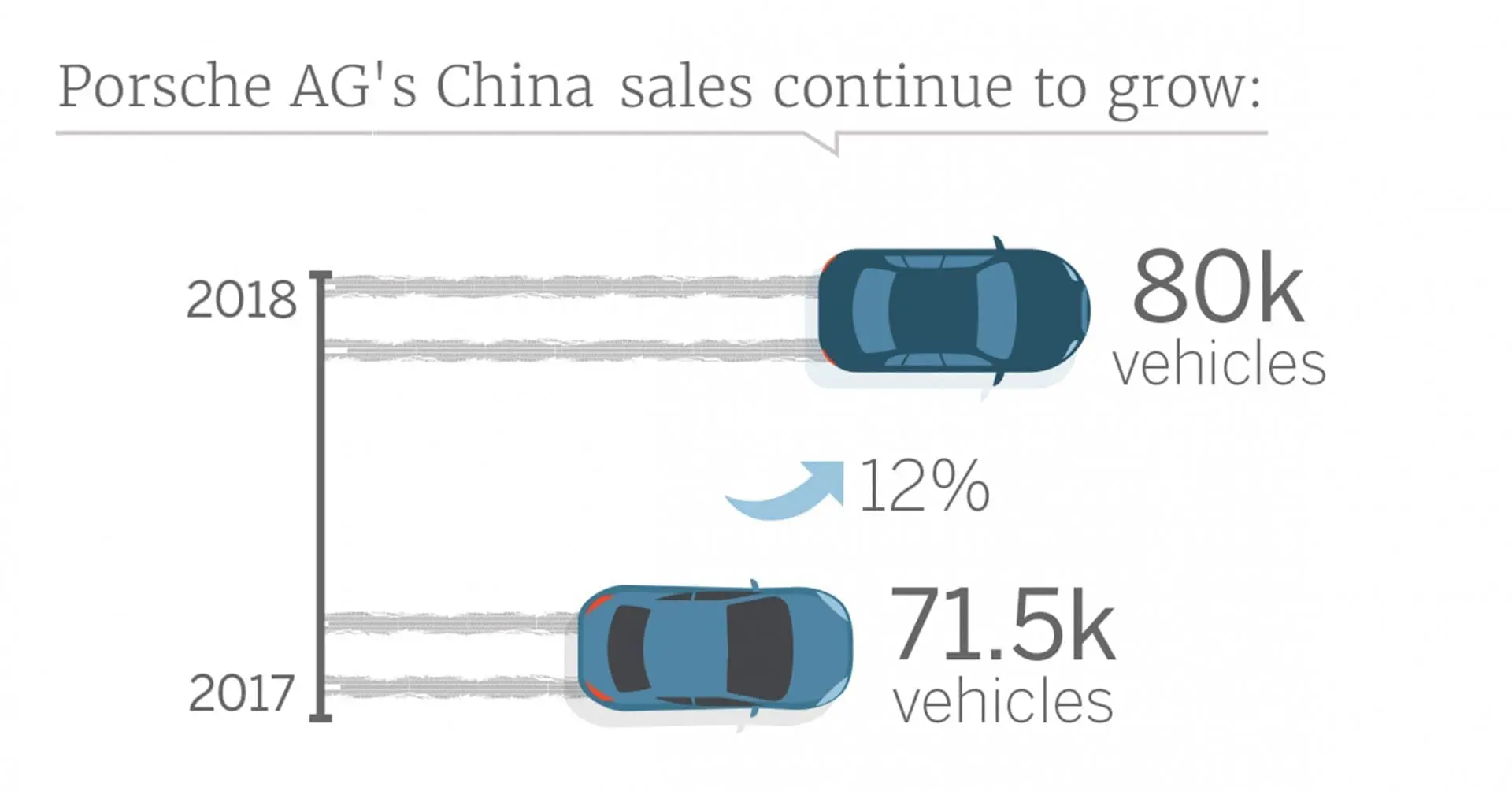

Presently, specialists are calling for JLR to scrap its JV with Chery and focus on importing vehicles from the UK. Although this would prevent JLR from offering Chinese consumers the current 20% discount – possible through reducing import expenses and by taking advantage of the Chinese government’s VAT reduction – our coverage on the industry suggests that affluent consumers are willing to pay a premium for imported goods, as long as the cost is in correlation to the quality. German brand Porsche AG is evidence of this, despite never having localised its products to the market in China, its percentage growth in the country has continually increased with sales volumes rising by 12% from 2017 to 2018.

Alternatively, JLR’s relatively poor performance in the premium market, our coverage suggests that JLR could “have a renaissance around electric vehicles.” Increasing emphasis is being placed on electric vehicles in China, this is exemplified by the implementation of the NEV credit scheme, which dictates that automotive manufacturers must sell 10% of NEVs as a percentage of their overall sales. Therefore, JLR focusing on electric vehicles would seemingly be a logical and timely way to re-establish its position in China. However, this move would find JLR pegged directly against Tesla and other reputable electric car brands in what is becoming an increasingly saturated market. This saturation is due to the Chinese government’s increased subsidies for the creation of electric vehicles by local companies in 2009.

However, despite being the market-leader in this space, Tesla has not had an easy ride recently either. The company has faced a number of publicity issues, including one of its vehicles catching on fire while sitting idly in a garage. Additionally, a ride-hailing company, Shenma Zhuanche, shamed Tesla extravagantly by purchasing advertising space in Time Square and using it to denigrate the company for its poor quality control. Furthermore, the insights we have gathered suggest that the production capacity of the company could be much lower than Elon Musk has anticipated, especially as Panasonic has seemingly been unable to supply the amount of batteries that the company requires to keep up with demand, and that Tesla’s use of automated production lines has caused technical problems, which could have contributed to the company missing its output targets.

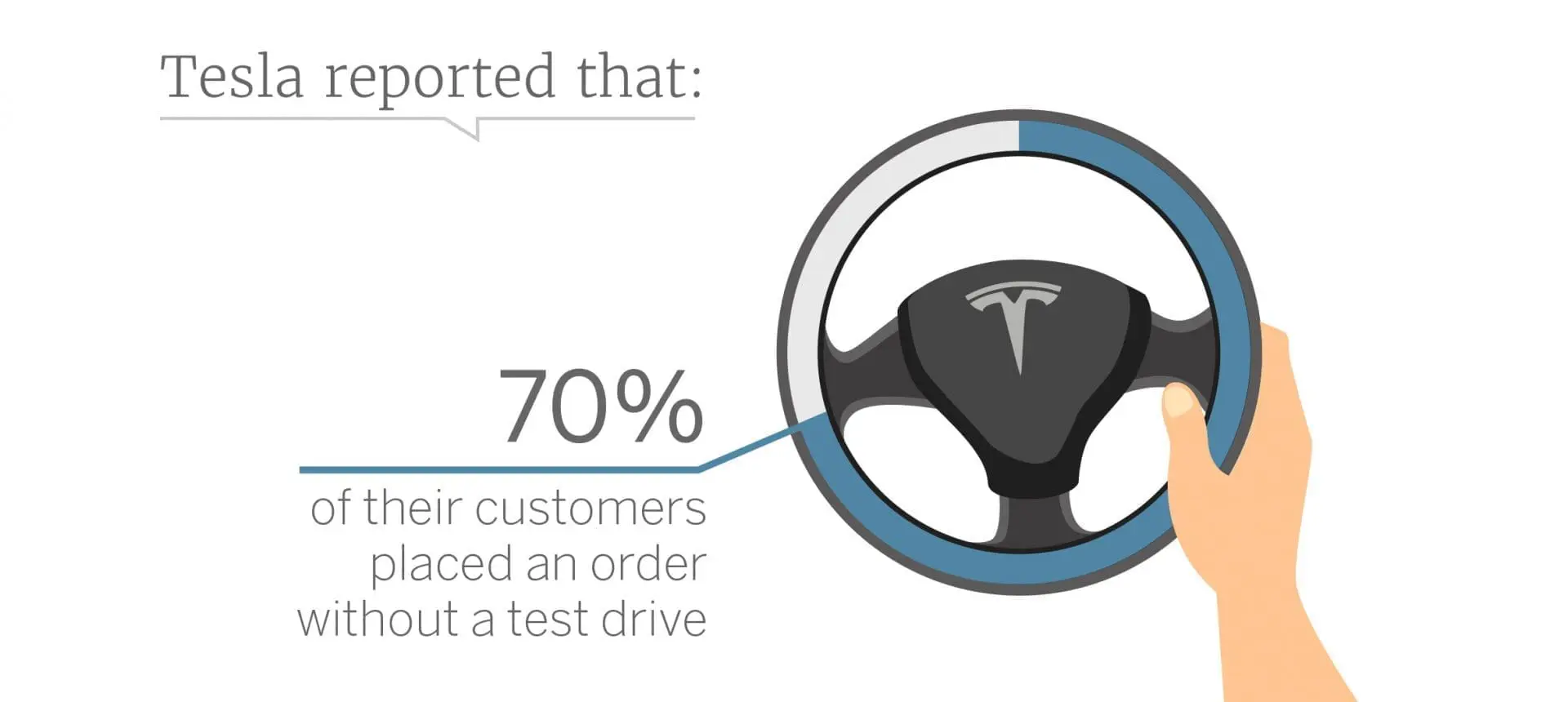

Following Elon Musk’s decision to shut down some of its physical stores in North America and instead shift sales online to pass savings on to customers, the market has questioned why Musk did not replicate this decision in China too. After all, “over 70% of Tesla’s customers placed the[ir] order without a test drive” and Tesla already has a strong brand recognition in first and second-tier cities such as Shanghai and Beijing. Instead, perhaps, Tesla should consider moving its physical stores to lower-tier cities to enable brand development and focus more heavily on online sales in larger cities. All this being said, the company has seen high profits from its entry into the Chinese market both directly and through online portals, such as Autohome Inc.

Although China’s leading online automotive portal Autohome has increased its membership fees, the costs involved in customer acquisition via the platform are still relatively low. Nonetheless, it must be noted that the conversion rate for Ping An-acquired Autohome has decreased from 8% to 4%, which specialists attribute to a decline in its sales lead quality. This, coupled with its subscriber price hike and poor client treatment, caused some dealers such as China Grand Auto to boycott the company earlier this year. Nonetheless, Autohome still obtain double the number of conversion rates compared to Bitauto and other competitors, who generally reside around 2%.

Mergers, acquisitions and partnerships are all too common in China’s automotive industry. As foreign automotive brands attempt to localise their product offerings by moving manufacturing to China, an increase in partnerships could be a key reason companies have faced brand dilution within the market. This issue has eroded consumer trust in premium foreign brands following late deliverables and inadequate quality. Therefore, the real question in the following months will be if and how companies are able to improve brand confidence once again.

The information used in compiling this document has been obtained by Third Bridge from experts participating in Forum Interviews. Third Bridge does not warrant the accuracy of the information and has not independently verified it. It should not be regarded as a trade recommendation or form the basis of any investment decision.

For any enquiries, please contact sales@thirdbridge.com