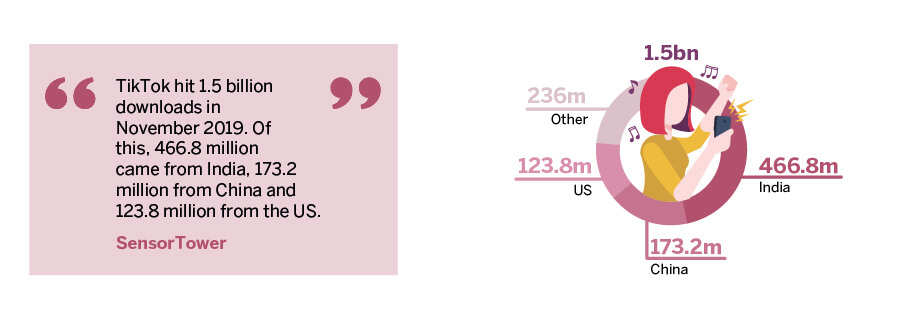

TikTok is one of the recent breakout platforms. Launched in 2016 in China, it is backed by internet technology company ByteDance, which is valued at USD 78bn. ByteDance acquired an app similar to TikTok, called Musical.ly, in November 2017, and merged the apps in August 2018, adding to its user base. There was “explosive growth” in 2018, and although the rate slowed in 2019 TikTok is still in growth mode.

Its main markets include the US, the UK and Japan. In Q1 2019 TikTok’s daily active users (DAU) surpassed 10 million in the US and were 5-10 million in Japan, while no country stood over 5 million in Europe. India has a much higher DAU, estimated at about 50 million, but is not considered a main market for TikTok owing to its lower average revenue per user – with such a huge population commercialisation would bring huge rewards, but developing advertising here “relies on the development of India’s economy slightly”. For the app, “creating top content is a core operational strategy.” Not only does it encourage users to provide their own high-quality content, but it can help attract different types of people. To this end, TikTok has partnered with entertainment celebrities in South Korea and football clubs in Europe.

There is also a darker side to TikTok. Some of its greatest challenges pertain to “inappropriate content such as child pornography, online predators, and legal and regulatory compliance”. There are two main regulations TikTok needs to comply with: the Children’s Online Privacy Protection Act of 1998 (COPPA) in the US and the General Data Protection Regulation (GDPR) in Europe. These affect both TikTok’s content distribution and “monetisation, because all ads on its platform are played to specific user groups, for which it must collect data on users’ behaviour.” Some of these problems have negatively affected TikTok’s image. It was even placed under investigation by the US’s Federal Trade Commission, with TikTok paying a fine of USD 5.7m in 2019 to settle allegations of collecting personal data of children under 13 illegally. However, the app has set up a department specifically to deal with government relations, as well as establishing a multi-tiered content review process and hiring a substantial moderation team. It’s also worth noting that such issues are not unique to TikTok.

Snap, established in 2011 in California, is the parent company of Snapchat and calls itself a “camera company”. Although it has faced some bumpy times, with singer Rihanna calling on people to delete Snapchat in 2018 leading to a nosedive in the app’s value, Snap’s fortunes are looking up. In Q3 2019, revenue stood at USD 446.2m, up from USD 297.7m a year earlier. Snap’s biggest rivals are Facebook and Instagram, although “TikTok may become a bigger competitor of theirs in the not too distant future.” Snap has zeroed in on the younger generation, around 13-30 years old – and this is precisely what enables it to compete against the much larger companies. When it comes to communicating, young people predominantly use Snapchat: “it’s not a phone call, it’s not SMS text, it’s not even Facebook Messenger or Instagram, they have accounts on those platforms, but it’s all primarily done through Snapchat.”

The fact that it’s focused on younger generations also perhaps stunts Snapchat’s ability to reach different age groups: “I think it’s a real challenge to have that app change in a way that makes it easier for a different demographic to really embrace it.” So when it comes to expansion, Snap’s next option is new geographies. In fact, the international growth rate is faster than that in the US, although America remains the largest market. Telecom infrastructure could be an impediment, though. Achieving a seamless experience on a content and video rich app requires fast connections. Meanwhile, Snapchat’s Android overhaul is being hailed as another reason that user numbers are increasing. Prior to its redesign, “you almost felt, as an Android user, a second-class customer.” Opening the camera, messaging and moving around the app are now a smoother experience. And as Android has a bigger user community, this has opened the app up to a much larger customer base.

YouTube is one of the older social media platforms, created in 2005. Its ecosystem is comprised of content creators, advertisers and viewers. Although it was probably the first player in online videos to become a household name, it’s facing competition from Facebook, which introduced a video service in 2007, live streaming in 2015-16 and Facebook Premiere in late 2018. Instagram, owned by Facebook, is also moving more into videos, offering Instagram Stories and IGTV. But one thing that sets YouTube apart is that it mixed long-form video content with a social aspect, and it is working with TV networks in order to bring new and varied material onto its site.

YouTube generates some of its revenue through advertisements. One of the strengths the platform has is a wealth of user data. This allows the company to build robust algorithms able to match suitable content to users, leading to longer watch times – and capturing more information. And these data points can also help advertisers promote their message to their target audience: “looking at what they view, how long they watched it for, what kind of content they subscribe to, and we recommended a certain video, did they end up going to watch that video? Those are all things that we look at when we think about building different ads.”

Different types of ads are needed for different clients, too. As YouTube is part of Google, advertising works through AdWords, which moved to goal-based advertising in 2015. This is something that has helped advertisers “demystify how to run these campaigns” – instead of working out what format to use, advertisers pick the desired result. Skippable ads are one of YouTube’s innovations and “wasn’t really something that was part of the industry norm when YouTube first launched it.” This goes back to the company’s philosophy of putting the users first, meaning that users only see ads that are relevant to them. And YouTube’s customers only pay if the ads are watched – reinforcing the importance of how YouTube selects who watches it. More recently, the company introduced “bumper” ads, which are six-second videos that were made largely in response to more mobile-based viewing. These have reduced the barrier to entry for a lot of advertisers, especially suiting those with lower budgets.

Various factors are shaping how social media companies operate today, but it’s clear that people’s need to share information and entertain each other is here to stay. With the deployment of 5G closing in, and its potentially huge ramifications for social media, this industry’s future looks like it could undergo continuous and exciting transformations.

所用信息均来自参与高咨询访谈的专家。高临咨询并未另行验证,不保证信息的准确性。本文件所包含的信息仅供参考,不具有任何形式的商业建议,对投资决策不具有影响力。

如有任何查询,请联系 sales@thirdbridge.com