PG&E, one of the largest providers of combined natural gas and electricity in the US, filed for bankruptcy in January 2019 after the weight of billions of dollars in claims over its role in deadly wildfires in California took its toll.

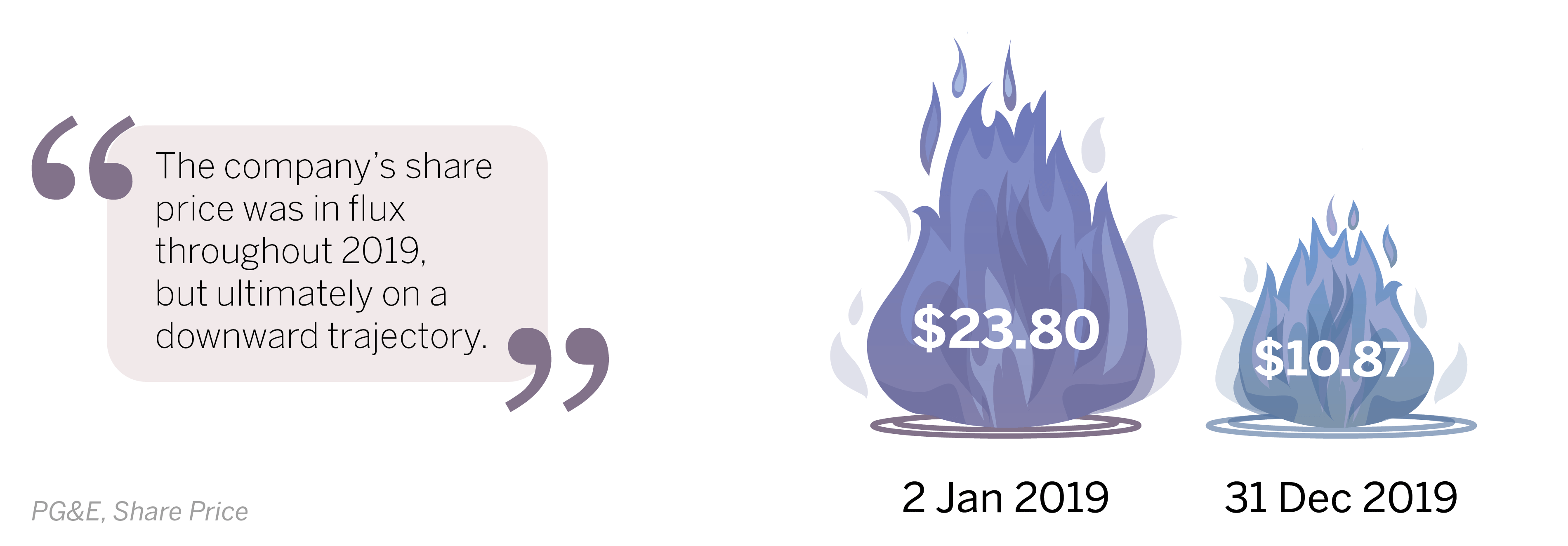

The ensuing months saw its share price in flux: it reached a high of USD 23.95 on 27 June soon after PG&E announced infrastructure improvements in high-risk areas but was ultimately on a downward trajectory, hitting a record low of USD 3.80 on 28 October and ending 2019 at USD 10.87.

It was also a tough year for the company’s bonds, starting the year with missed interest payments,[mfn]https://www.reuters.com/article/us-pg-e-us-bankruptcy/pge-plunges-for-second-day-after-step-toward-bankruptcy-idUSKCN1P91V5[/mfn] while the company reported a net loss of USD 1.6bn in its Q3 2019 results, compared to USD 564m in net income a year earlier.[mfn]https://www.businesswire.com/news/home/20191107005599/en/PGE-Corporation-Reports-Third-Quarter-2019-Financial-Results[/mfn]

As several specialists emphasised to Third Bridge Forum, the situation was and continues to be very complex, with a range of other factors — including the political and regulatory landscape in California and climate change — at play. As one specialist we spoke to in September 2019 pointed out, each fire also “has its own tranche of thorny issues attached to it”.

In December 2019, PG&E reached what it claimed was a final and major settlement of USD 13.5bn with individuals affected by the 2015 Butte Fire, the 2017 Northern California wildfires and the 2018 Camp Fire — the most catastrophic of them all, killing 86 people. It had previously reached a USD 1bn settlement with cities, counties and other public entities, and a USD 11bn agreement with insurance companies and other claimants.

The company said the agreement, which also covers claims related to the 2017 Tubbs Fire and 2016 Ghost Ship Fire, puts it on a “sustainable path forward” to emerge from bankruptcy by the 30 June 2020 deadline to participate in California’s wildfire fund.

However, its future still remains uncertain. A specialist we spoke to in September said “everything is still doable” when asked whether PG&E could realistically exit bankruptcy by the deadline. But there is still a long way to go and there will continue to be headwinds. For example, the company has faced “severe scrutiny” by state regulators and customers over its sweeping blackouts between October and November 2019.[mfn]https://www.cnbc.com/2019/10/23/pge-rebuked-over-imposing-blackouts-in-california-to-reduce-fire-risk.html[/mfn] PG&E is also still waiting for the green light from California Governor Gavin Newsom, who rejected the company’s exit plan in December.

One of the most significant challenges affecting PG&E and other utilities is California’s doctrine of inverse condemnation. It dictates that if a utility has a “causal relationship” with any damages — meaning negligence does not have to be a factor — it is strictly liable. Another relates to vegetation management, a big component of operational expenditure. Vegetation management is “incredibly daunting” because of the way the laws are written, making it the biggest challenge in maintaining safe systems, according to another expert. “There are folks quite frankly who don’t want their trees down,” they said, adding that this is the “most dangerous work” for utilities.

Meanwhile, the increased ferocity of wildfires in the Golden State has been widely described as the “new normal”. Five years of drought and bark beetle infestation, compounded by “incredibly high” temperatures, have left forests “like a giant tinderbox”. And it takes very little for these fires to start; once they’re aflame and wind speeds pick up, “they’re almost impossible to stop”. Undeniably, a glaring factor at the centre of this issue is climate change, which is said to be exacerbating wildfires in California as well as other parts of the world, notably Australia.

Ultimately, there is “no perfect system” in any state or country for preventing wildfires. In order to prevent the situation from worsening, “there needs to be some other approaches taken”. The company’s decision to switch off power last year signalled a “cultural” shift from focusing on 100% reliability to maximising safety. However, that move was not well received by all. “Folks do not want to have their services interrupted,” one of the experts observed. As echoed by another: “This is a really political state, and there is no agreement on what the solutions are, and I think that’s part of the problem.”

Investors will no doubt be closely following PG&E as the deadline nears, including how it delivers safe and reliable energy and bolsters its resilience to the growing threat of wildfires. After all, this isn’t the first time the company has filed under Chapter 11, having done so in 2001 during the California energy crisis.

One specialist warned that amid all this, retaining and attracting talent is increasingly problematic for PG&E in light of all that has happened. “It’s now officially a problem,” he said. “Everyone’s heard of their woes.” This can also materialise as operational risk, with more leadership changes likely to further disadvantage the company. “This is the fifth team inside of 15 years, so there’s been zero continuity,” he pointed out. A related challenge is how capital investments will be funded going forward, with management likely to bear the brunt of cost-cutting moves.

Read other articles on Thomas Cook, Boeing, Sealed Air, Babylon and Disney.

所用信息均来自参与高咨询访谈的专家。高临咨询并未另行验证,不保证信息的准确性。本文件所包含的信息仅供参考,不具有任何形式的商业建议,对投资决策不具有影响力。

如有任何查询,请联系 sales@thirdbridge.com