Robotics, as one specialist states, has generally always been cyclical. Following the 2008-09 financial crisis, there was close to ten years of “unprecedented growth”. But geopolitical factors, trade wars and uncertainty over the future of private mobility have led to a decline in manufacturing, in turn affecting the robotics industry. Despite this gloom, there are signs that the downturn is nearing its end. And, as there is an ongoing need to automate, “the only thing that happens when there is a slowdown like this is that demand is just being built up.” Add to that a forecasted labour shortage, and it’s clear to see that it’s only a matter of time before things pick up.

The “big four” robotics manufacturers are ABB, Fanuc, Kuka and Yaskawa. Another notable company is Universal, which makes collaborative robots, otherwise known as cobots. According to one Interview, Universal has been underestimated by the big four and is taking market share from them. This is partly owing to the fact that Universal has focused more on small and medium-sized enterprises (SMEs). This is “typically the area where the big four do not play too well”, as it’s harder for SMEs to adapt to the technology offered by larger companies. However, there comes a time when SMEs would be better served by the big four, for instance when requiring higher robot density. The big four could also challenge Universal with new offerings in 2020: “I would expect at least two of the four coming out with some kind of competing product in order to try to stop Universal’s market share growth.”

China is the world’s biggest robot market, as well as a substantial producer. Despite figures from the China Robot Industry Alliance showing the sales volume of robots dipping in 2018 year on year, China remained first for annual sales globally for the sixth consecutive year. One type of robot, the selective compliance assembly robot arm (SCARA), is closely linked to 3C products – computers, communication products and consumer electronics. Although there have been limited growth drivers for SCARA in 2018-19, there is the potential for it to pick up over the coming years.

SCARA’s rosy prospects can be attributed to two things, according to a specialist Third Bridge spoke to. The first is 5G. In June China’s Ministry of Industry and Information Technology issued four 5G licences, paving the way for commercial deployment. 5G smartphones “will comprise more antennas and new parts, and the production technologies and techniques involved are bound to change.” And SCARA will play a vital role in making these. Consequently, production lines will need to be updated, which could affect mobile phone brands including “Apple, Oppo, Vivo and Huawei, and their OEMs [original equipment manufacturers], such as Foxconn and Wingtech”. The second area that could fuel uptake of SCARA is the development of intelligent vehicles: “with the development of intelligent cockpits, the demand for SCARA robots from the auto industry will increase a lot.”

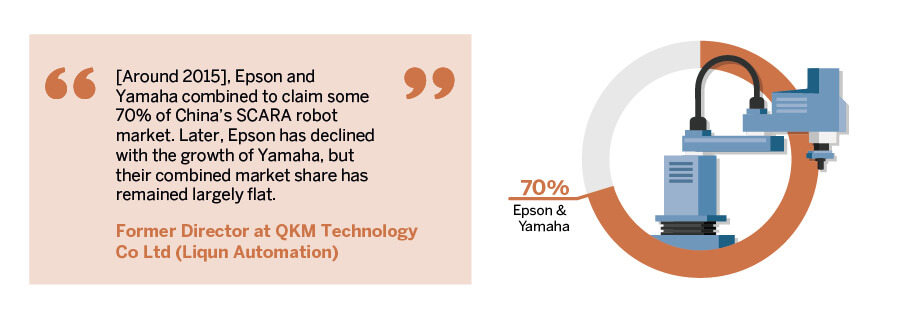

The main players in China’s SCARA market are Epson and Yamaha, claiming about a 70% share. Mitsubishi Electric and Toshiba Machine are other notable companies working in this space. Domestic SCARA manufacturers looking to expand their market share face barriers, “including fixed investments, patents, technologies and business operations. They will incur high procurement costs, if their business volumes are small.” But one way for Chinese manufacturers to differentiate themselves is through offering integrated industry solutions, as, the specialist notes, they “have not seen any foreign player that offers integrated solutions involving SCARA robots for the 3C industry”. This service is already offered by the big four, and the “profit margins on integrated solutions can be very considerable.”

Supply-chain management is also being shaken up. One of the leading suppliers in this area is Dematic, which offers automated supply-chain technology, software and services. This company “excels on the fact that they can cover any type of solution for any type of customer of any size.” A specialist noted that since 2018 the “appetite for companies to actually invest in this market has grown”. Prior to this, there was uncertainty over what Amazon – one of Dematic’s largest customers – was going to do regarding investing in its supply chain. However, “since then they have actually eased and realised that they need to invest, become more agile, deal with the level of shortage and they have to make a lot of investment. However, most of those investments remain still in the North America area, followed very closely by Asia.”

Customers are “becoming more aggressive in what they need, what they want, what they’re asking [for].” Not only is this forcing companies like Amazon to step up now, but there is also the need to prepare for future needs. As the pace of demand for quicker delivery continues to grow, it has been forecast that by 2023 “companies are not going to be able to hire enough people to actually handle their orders manually, which requires… for them to invest in automation.” One way of meeting this demand is through micro-fulfillment centres. Although this is an emerging market, one specialist thinks demand for these will “explode” over the next few years. Dematic is relatively new to this area, recently launching one centre with grocery store supplier Meijer. However, Knapp is way ahead – in April 2019, partnering with Takeoff Technologies, it confirmed a USD 150m order for 50 micro-fulfillment sites in the US.

Knapp, which also provides automation technology, is taking market share from Dematic. They don’t cover as many sectors as Dematic, allowing them to be more focused and agile. This benefits them “not only when putting a proposal together but also when they need to be aggressive and be cost-effective”. In addition, “their technology is pretty innovative.” Some of the other incumbents in this sector include SSI, Schaefer, Intelligrated and Vanderlande.

Automation is expected to shape the future of manufacturing, and there is plenty more potential to uncover. As new technology evolves and consumer demands change, automation could transform industries into something not yet fathomable.

所用信息均来自参与高咨询访谈的专家。高临咨询并未另行验证,不保证信息的准确性。本文件所包含的信息仅供参考,不具有任何形式的商业建议,对投资决策不具有影响力。

如有任何查询,请联系 sales@thirdbridge.com