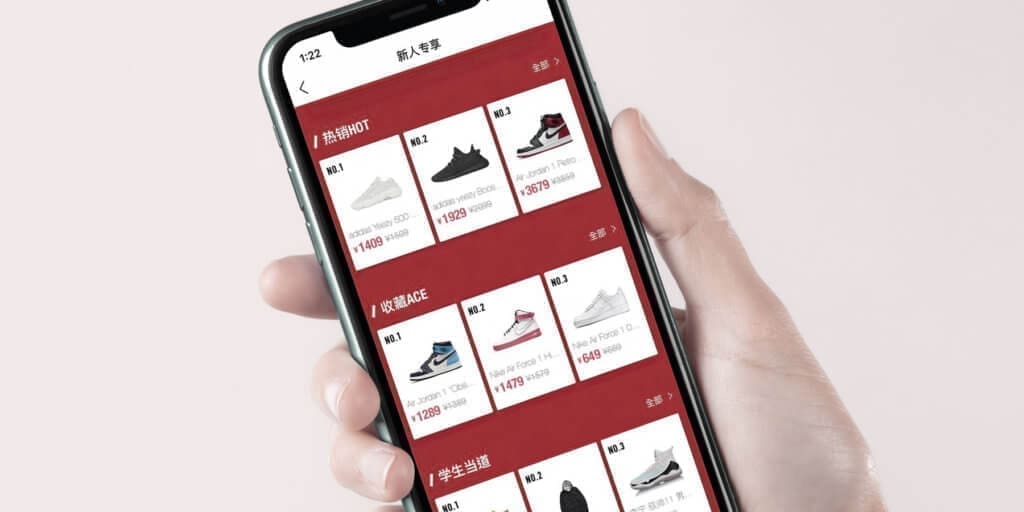

Poizon – China’s latest e-commerce platform

In an Interview with Third Bridge Forum, the specialist described Poizon’s evolution from a social networking and authentication platform to a fashion e-commerce community selling high-end streetwear. Poizon has since added an offline branch called Poizon X, which the specialist told us had “not been developing well”. They claimed this is because Poizon executives had not taken this area of the business “seriously”, highlighting their failure to recruit personnel with sufficient offline experience.

To increase its brand recognition, the specialist said Poizon should follow competitors such as StockX and Goat by participating in offline exhibitions. The specialist claimed Poizon’s experience selling American, Japanese and Korean fashion since its inception has given it an advantage over competitors. Well-established ties with overseas distributors and buyers are also advantages for Poizon, helping it to improve overseas supply chains, we were told.

The specialist said Poizon differs from competitors by enabling users to sell their own products on the platform – something they say “increases” the company’s revenue. Poizon is also more competitive on price than StockX and Goat, according to the specialist. However, they say its reputation abroad “lags behind” both.

The specialist described Poizon as a “leader” among fashion e-commerce and authentication platforms in China. However, they are sceptical about the company’s growth trajectory. There are “major disagreements” between Poizon’s COO and CEO on the company’s strategy, as well as questions about the cost and efficiency of authenticating such products, they said. The specialist also claimed Poizon does not have a good relationship with brands and supply chains, and, as a result, brands are “not willing” to cooperate with the company. The specialist added that without brand cooperation, Poizon’s gross merchandise value (GMV) is unlikely to be “significant” in the future.

Despite these problems, the specialist believes Poizon will continue to enter more Tier 3 and 4 cities in China, which could help raise its GMV to RMB 200bn. They also said further advertising on video-sharing apps Kuaishou and Douyin could help it reach 28-30 million daily active users.

Poizon’s overseas operations are also “doing well”, growing faster than its operations in the domestic market at the same stage of development. The specialist speculated that its performance overseas might lead the company to go public outside of China, having previously failed to IPO in the country.

To access all the human insights in Third Bridge Forum’s Poizon – online fashion marketplace & community development & outlook Interview, click here to view the full transcript.

* OECD

* EUIPO

The information used in compiling this document has been obtained by Third Bridge from experts participating in Forum Interviews. Third Bridge does not warrant the accuracy of the information and has not independently verified it. It should not be regarded as a trade recommendation or form the basis of any investment decision.

For any enquiries, please contact sales@thirdbridge.com